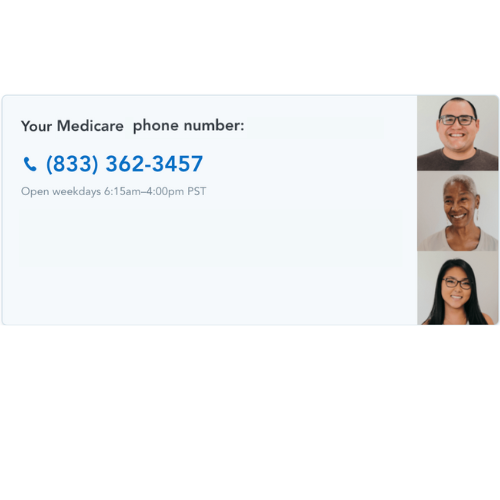

CALL NOW

FOR

MEDICARE

About us

Our commitment to

Affordable Health Care, Auto, Home & Renters Insurance plans

Prime Shield is an insurance agency committed to making quality healthcare accessible and affordable for everyone. Specializing in plans available through the Affordable Care Act (ACA), Prime Shield connects individuals and families with top-rated health insurance providers at the best possible rates. By focusing on personalized service, they ensure that each client finds coverage tailored to their unique healthcare needs and financial circumstances. With a deep understanding of ACA options, Prime Shield simplifies the enrollment process and guides clients through each step, helping them secure comprehensive, reliable, and cost-effective health insurance that promotes long-term well-being.

Primary Care

Skilled nursing care

Physical Therapy

After surgery care

Speech Therapy

Pediatrics

Choose from a range of affordable health care insurance providers for your specific needs

Our benefits at a glance

Cost-effective

Prime Shield is an insurance agency dedicated to connecting individuals and families with high-quality, affordable health insurance options through the Affordable Care Act.

Skilled care

By partnering with top providers, Prime Shield ensures cost-effective coverage tailored to each client’s needs, making healthcare accessible without compromising on quality.

Comfort

Their expert guidance simplifies enrollment, helping clients secure comprehensive insurance at the lowest possible rates.

Affordable health professionals & specialists at your finger tips

Head of clinic

Family doctor

Therapist

Speech therapist

Hospice nurse

Nutritionist

Insurance Plans

Health Insurance

Health insurance helps cover the cost of medical care, including doctor visits, hospital stays, prescriptions, and preventive services, reducing out-of-pocket healthcare expenses. It provides financial protection and access to essential care when you need it most.

Home Insurance

Homeowners insurance protects your home, personal belongings, and finances from covered risks such as fire, theft, storms, and liability claims. It also helps cover temporary living expenses if your home becomes uninhabitable after a covered loss.

Auto Insurance

Auto insurance provides financial protection against accidents, vehicle damage, theft, and liability for injuries or property damage caused to others. It helps keep you legally compliant and financially secure on the road.

Renters Insurance

Renters insurance protects your personal belongings and provides liability coverage if someone is injured in your rental home. It also helps cover additional living expenses if your rental becomes uninhabitable due to a covered event.

_gif.gif)